26+ Boat Taxes In South Carolina

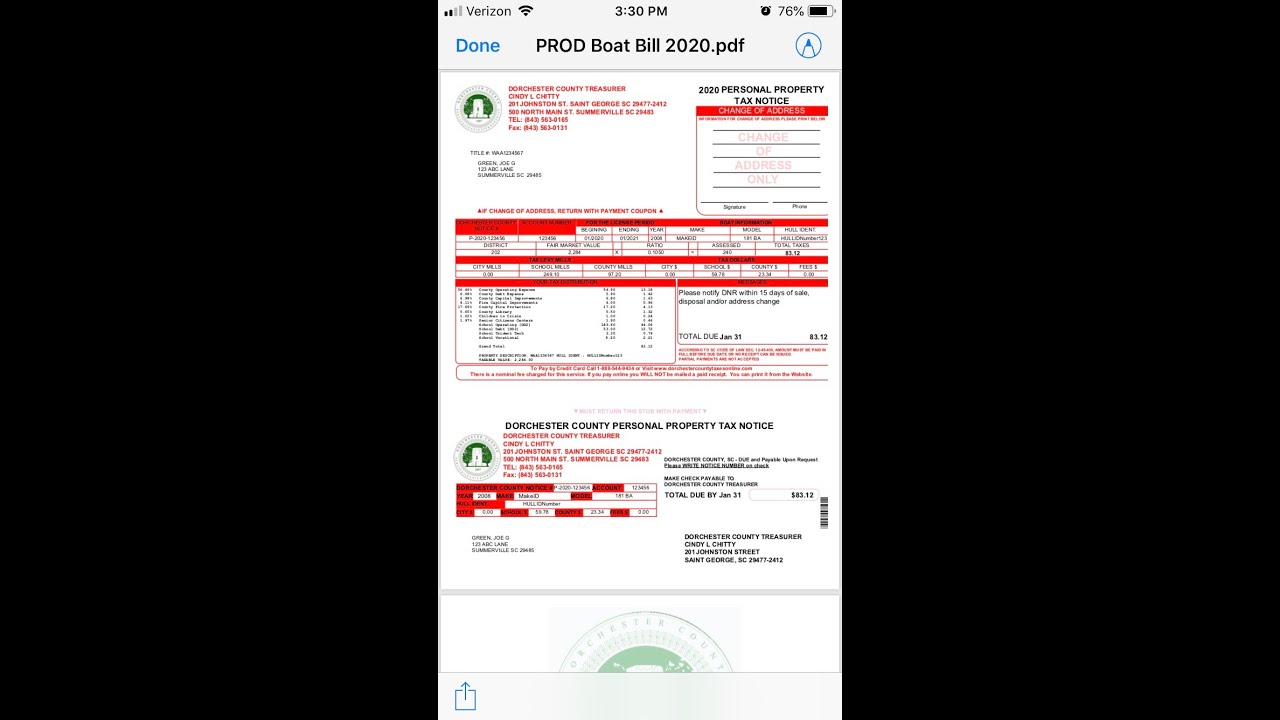

Web The SCDNR registration renewal fees will not be included on the property tax notices for 2019 or 2020. Web Property Tax on Watercraft.

Voting Rights In The United States Wikipedia

Unlikely that anyone from SC will see this but IF you have a SC.

. Web Boats and Jet Skis The SCDMV does not title nor register watercrafts like boats or jet skis. That post was to update Critters list. Web South Carolina has an effective property tax rate of just 055 with a typical annual property tax payment of 980.

Web Lowest taxes of all the places we were interested in retiring but the highest cost of real estate. Part of the reason taxes are so low is that owner. Web Beginning in January boat owners and buyers will see changes in the way boat registrations are issued by the South Carolina Department of Natural Resources.

Boat tax is subject to change by state and local legislation and its application can change based on the facts. January 1 2021 749 AM. Is There Property Tax On Boats In South.

The tax is effectively a sales tax and applies to both new and used. LOGIN Subscribe for 1. To amend the South Carolina Code of Laws by amending Section 12-37-890 relating to Place where property shall be returned for taxation so as to provide.

Web Level 15. Under the new process they will pay 10 annually. Alcoholic beverage excise and sales taxes in South Carolina are among the highest in the US.

Web A bill. Thu Feb 09 2023. SCDNR will issue the renewal notices in the same manner they did in past.

Web The tax rate is 5 of the fair market value of the airplane motor or boat purchased. Getting back to boating in Delaware there is no sales or personal. If youre interested in titling your boat or jet ski contact the South Carolina Department.

Web 7 hours agoDoyle has been missing since January 26 when his boat sank near the Little River jetties in South Carolina. Web The frantic search for a South Carolina duck hunter last seen slipping from his swamped jon boat on Jan. Fair market value is defined as.

Under South Carolina law you are required to pay personal property taxes on watercraft. Please call for advice concerning you. 26 has crossed state lines as volunteers and authorities.

In addition to general state and local. Web When you buy a boat or boat motor in South Carolina you have to pay a casual excise tax. As of January 1 2020 the way watercraft are taxed will.

Web South Carolina Alcohol Tax. Web Under the current system boat owners register their vessels for 30 for a three-year period. The total purchase price price agreed upon by the buyer and.

Web When it comes to flat rates the North Carolina sales tax on boats is 3 percent but capped at 1500 and in New Jersey its 33125 percent but in Florida its 6. Web The average effective property tax rate in South Carolina is just 05 5 with a median annual property tax payment of 980.

Northwest Observer May 19 June 1 2022 By Pscommunications Issuu

54 Hgs Pdf Deposition Geology Stream

Sc Boaters Can Expect Changes For Tax Collections In 2020 Wbtw

Sailing World June 2006 Pdf Water Sports Boats

Horry County To Implement New Boat Tax System Due To Millions In Unpaid Taxes Wpde

Sc Boat Registration Taxes Change In 2020 Hilton Head Island Packet

Boats Motors And Watercraft Property Tax Dorchester County Sc Website

Beaufort Co Proposes New Tax Change Of Government Form Hilton Head Island Packet

Sc Boaters Can Expect Changes For Tax Collections In 2020 Wcbd News 2

Chapter 26 City Of Punta Gorda

South Carolina Income Tax Calculator Smartasset

Ideal Boat For The Bay Under 50k R Boating

Harshaw Rd Murphy Nc 28906 Mls 321704 Trulia

South Carolina Income Tax Calculator Smartasset

Phoenix On The Bay Ii 2308 Gorgeous Bay View Dog Friendly Phoenix On The Bay Ii Vacation Condo Or Apt Townhouse Alabama Vacation Home Rentals

Don T Just Visit Explore Carolina Beach Nc In Carolina Beach North Carolina Courtyard By Marriott

Beware The Long Arm Of The South Carolina Assessor S Office Property Taxes On Vessels In Sc Cooper And Bilbrey P C